PAST WEEK'S NEWS (June 09 – June 13)

Canada announced increased defence spending to meet NATO's 2% GDP target this fiscal year. Prime Minister Carney warned of "new imperialism" while NATO chief Rutte's stark messaging of "wishful thinking will not keep us safe" and warnings to "learn to speak Russian" as tension heightened in the region. Prime Minister Mark Carney committed an additional C$9 billion ($6.58 billion) for military recruitment, equipment repairs, and new defence partnerships, with prospect of further spending given the need to modernise outdated equipment and reduce reliance on the US. Rutte emphasised NATO needs a "quantum leap" in collective defence capabilities, citing Russia's ability to produce in three months what NATO takes a year to manufacture. The spending increase will fund new submarines, aircraft, ships, armoured vehicles, artillery, radar systems, drones, and higher military pay, though economists warn it will significantly expand Canada's budget deficit.

Israel launched "Operation Rising Lion" on June 12th, claiming to strike key Iranian nuclear sites, including Natanz, an unprecedented escalation in the Israel-Iran nuclear standoff. The attack followed an IAEA declaration that same day confirming Iran had violated its non-proliferation obligations for the first time in 20 years, based on findings of undeclared nuclear activity dating back to May 31. In response, Iran released what it claimed were classified Israeli documents, alleging collusion between Israel and the IAEA. The IAEA’s findings stand against Iran’s long history of compliance: it was previously cited for violations in 2005, referred to the UN Security Council in 2006, and has failed since 2019 to explain uranium traces found at undeclared locations. It claims Iran now enriches uranium to 60% purity and holds enough material for several weapons, an action that aligns with IAEA assessments rather than Tehran’s claims of bias. Iran warns that sustained pressure may lead it to withdraw from the NPT, raising diplomatic stakes, while Israel has not signed the treaty and is estimated to hold 90 nuclear warheads.

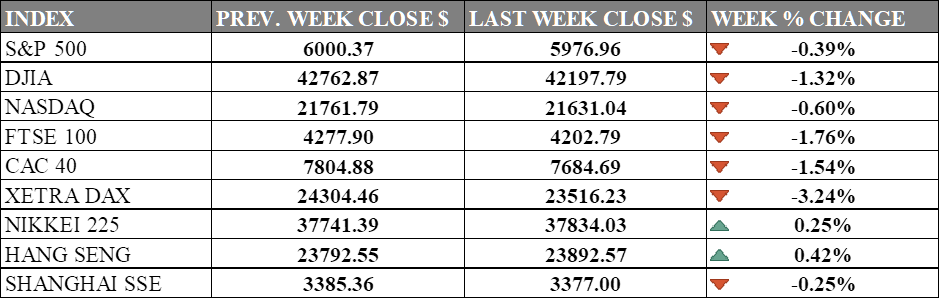

INDICES PERFORMANCE

Wall Street faced headwinds last week, with market confidence declining across major indices. The S&P 500 fell 0.39%, closing at 5976.96, as negative economic sentiment weighed on investor confidence. The Dow Jones Industrial Average (DJIA) posted more significant losses of 1.32%, finishing at 42197.79. The Nasdaq also declined with a 0.60% decrease, closing at 21631.04, as tech stocks faced selling pressure throughout the week due to rate concern. The selloff was sparked by the Fed signalling just two rate cuts in 2025, down from four even with a 25-point cut, disappointing investors hoping for more aggressive easing.

European markets also showed negative momentum during the period, with more pronounced declines than their American counterparts. The UK's FTSE 100 fell by 1.76%, closing at 4202.79. France's CAC 40 decreased by 1.54%, ending at 7684.69, while Germany's XETRA DAX demonstrated the weakest performance with a 3.24% decline, closing at 23516.23. European markets struggle with Middle East escalation ahead of G7 meet in Canada.

Asian markets were mixed, with notable regional variations in performance. Japan's Nikkei 225 managed modest gains of 0.25%, closing at 37834.03, moving against the negative trend as it vows to keep easy money policy. Hong Kong's Hang Seng Index also posted small gains of 0.42%, finishing at 23892.57. In mainland China, the Shanghai Composite Index showed slight weakness with a 0.25% decline, ending at 3377.00, reflecting cautious trading activity in the region.

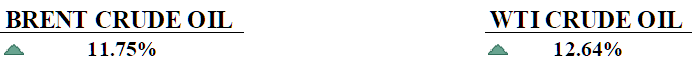

CRUDE OIL PERFORMANCE

Oil prices faces significant volatility this week as the Israel-Iran conflict escalated into direct military strikes on critical energy infrastructure, with Brent crude rising 11.75% and WTI 12.64%. The market surge began Friday with an 8% jump following Israel's coordinated airstrikes on Iranian facilities, including the Shahran fuel depot and Shahr Rey oil refinery in Tehran, which destroyed at least 11 storage tanks and sparked massive fires. In a major escalation, Israel struck Iran's South Pars gas field, the world's largest, temporarily halting 12 million cubic meters of daily gas production and marking the first direct attack on Iran's core natural gas infrastructure. Iran retaliated with drone and missile strikes targeting Israeli facilities, including the Haifa oil refinery, amplifying broader regional conflict and supply disruptions through the crucial Strait of Hormuz shipping channel. The two-day price increase represents one of the sharpest rallies in recent years, with Brent opening over 4% higher Sunday evening above $77 per barrel as markets priced in risks to Middle East energy supplies. President Trump's comments suggesting the nations may need to "fight it out" before reaching a ceasefire, combined with Iran's cancellation of nuclear talks with the U.S. although U.S. distancing itself from the conflict helps to insert stability.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment rose to 60.5 in June from 52.2, beating forecasts, as U.S.-China trade tensions eased, but gains were clouded by Israel-Iran conflict driving oil prices up and inflation expectations down to 5.1% from 6.6%, with long-run views still high at 4.1%.

U.S. consumer prices rose 2.4% year-over-year in May while core inflation held at 2.8%, as falling energy costs offset rising shelter prices. Markets are now expecting no rate cuts until September.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Federal Reserve's Federal Open Market Committee is widely expected to keep its benchmark interest rate the same at its upcoming meeting. This option comes as the central bank continues with its wait-and-see strategy and a strong labour market.

BoE Interest Rate Decision: The Bank of England recently cut its interest rate from 4.5% to 4.25% in May, marking its second cut this year. Analysts anticipate further rate cuts later in 2025 as the central bank responds to economic conditions, but none were expected for June.

SNB Interest Rate Decision: The Swiss National Bank last lowered its policy rate by 25 basis points in March, with another cut in line, possibly toward negative territory in the near future. The decision came as the country suffers from low inflationary pressures and deflationary risks to its economy.

PBoC Loan Prime Rate: The People's Bank of China cut its benchmark lending rates for the first time since October last year, with the one-year Loan Prime Rate lowered to 3.0% from 3.1%, and the five-year LPR was down to 3.5% from 3.6%.

US Retail Sales: Consumer purchases were down to 0.1% in April compared to March's inflated figure from trade tension fears but revealed a 4.7% increase from April of last year. This indicates a slight monthly dip but continued year-over-year growth in consumer spending.