PAST WEEK'S NEWS (August 29 – September 4, 2022)

Last week included the end of August and the beginning of September. With both looked roughly the same as stocks finished lower for the week. Investors continued to digest the implications of hawkish messages from Federal Reserve officials.

The market reacted negatively to Federal Reserve Chairman, Jerome Powell’s speech in Jackson Hole, Wyoming, as he described the Fed’s position on raising interest rates to tamp down inflation. The hawkish remarks reminded investors that bringing down prices “is likely to require a sustained period of below-trend growth” and increases in the overnight rate. The need to bring inflation levels down to 2% requires aggressive rate hikes and “some pain for households and businesses” in 2023 and should be expected.

Markets are now entering the historically volatile months of September and October with a Fed and global central banks poised to move rates higher and implement quantitative tightening balance sheet reduction programs. In this backdrop, we would expect bond yields to also grind higher, putting downward pressure on equities, particularly higher valuation growth sectors of the market.

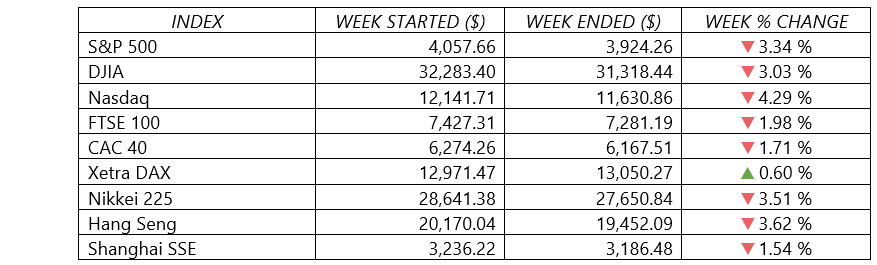

Indices Performance

The major U.S. stock indexes fell around 3% to 4%, marking the third weekly setback in a row for the S&P 500. The decline was steepest for the NASDAQ, which has fallen nearly 11% over the past three weeks.

Shares in Europe fell sharply on fears that central banks could tighten monetary policy aggressively for an extended period. Worries that Russia might stop natural gas supplies to Europe also weighed on sentiment.

Japan’s stock markets fell over the week. A hawkish outlook on U.S. interest rates dampened investor sentiment.

China’s stock markets fell as coronavirus outbreaks in major cities triggered renewed lockdowns and dampened the economic outlook.

Crude Oil Performance

Oil benchmarks were on steep decline last week as fears of China's COVID-19 curbs and weak global growth weighed on the market. The market feared that more aggressive interest rates hike from central banks may lead to a global economic slowdown and soften fuel demand.

Other Important Macro Data and Events

Growing expectations for further sharp interest-rate increases weighed on prices of U.S. government bonds, sending the yield of the 10-year U.S. Treasury bond up for the fifth week in a row. The yield climbed to around 3.20% on Friday, up from 2.64% at the end of July.

Before closing the week at 3.40%, the yield of the 2-year U.S. Treasury bond on Thursday climbed to 3.52%, the highest level since 2007. The 2-year yield is especially sensitive to the near-term outlook for U.S. Federal Reserve policy and expectations for another big interest-rate increase to be announced on September 21.

The dollar index was steady for a third straight weekly rise as it stood near its two-decade top at 109.99. It hit a fresh record high on safe haven flows due to global economic weakness and as the country’s resilient economy paves the way for the Fed to remain aggressive in its rate hikes.

Japanese yen plunged on expectations of continued monetary policy divergence between the Fed and the BoJ, which remains committed to maintaining ultralow rates. Japan’s yen was trading at around 140 to the U.S. dollar on Friday, its lowest level since 1998. The yen’s value relative to the dollar has fallen around 18% year to date.

Friday’s August jobs report from the Department of Labor showed that the economy added 315,000 jobs last month, a number seen as solid though down from a revised 526,000 in July. The unemployment rate rose to 3.7% from 3.5%, but that increase stemmed in part from a rise in the labor force participation rate. Earlier in the week, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) for July indicated that job postings unexpectedly increased, reaching nearly two per unemployed worker.

Companies in the S&P 500 posted an average second-quarter earnings gain of 6% over the same quarter a year earlier, according to FactSet data from the recently concluded earnings season. That result marked the slowest growth rate since the fourth quarter of 2020. For the second quarter in a row, energy was the strongest among all 11 sectors, with earnings growth of 293% in the latest quarter.

What Can We Expect from the Market this Week

Central bank meetings are front and center globally in the week ahead with the with the RBA, ECB and the BoC all ready to tackle inflation. The ECB is expected to hike rates 75-bps after recent remarks from members turned more hawkish, although there is still some speculation of a 50-point increase. For Federal Reserve watchers, the Beige Book report will be released, and Jerome Powell will make a notable conference appearance.

Economic reports due in during the week for the U.S. include updates on trade balance, imports and exports, consumer credit, weekly unemployment claims, and wholesale inventories.

In the energy market, the OPEC+ meeting will take place amid more talk about output cuts with some producer nations forecasting near-term oil surpluses.

The earnings calendar slows down for the holiday-shortened week, although the reports from GameStop, DocuSign, and Kroger are likely to create some buzz. Other earnings reports pouring in include from Gitlab, Nio (NIO), and Smith & Wesson Brands.