PAST WEEK'S NEWS (September 15 – September 19)

Nvidia’s $5 billion investment in Intel backed by the administration marks a strategic shift from pure competition to cooperative “coopetition” in the AI industry. The deal gives Nvidia about 4% ownership in Intel and establishes joint development on AI infrastructure, blending Nvidia’s NVLink with Intel’s x86 to capture AI demand while reducing risk. This partnership reflects a broader trend where tech giants act simultaneously as competitors, suppliers, and partners—seen also in Microsoft, Oracle, Google, and Palantir’s overlapping AI alliances. Such interdependence creates a more stable but complex equilibrium, where long-term cooperation and reputation matter more than short-term wins. Ultimately, the AI industry is maturing into an ecosystem where success depends on positioning within circular revenue flows rather than dominating individual markets.

China and the U.S. have finally struck a provisional deal to avert TikTok’s U.S. shutdown by transferring control to a U.S.-owned entity, with Chinese stakes capped under 20% to comply with federal law. A consortium led by Oracle, Andreessen Horowitz, and Silver Lake is structured to operate a new domestic entity, licensing ByteDance’s algorithm, and storing data via Oracle in Texas. Beijing consented to license core IP after Trump threatened enforcement, reversing months of deadlock triggered by earlier tariffs. Treasury Secretary Bessent credits Trump’s ultimatum as the turning point, with final terms awaiting confirmation in Friday’s Xi-Trump call. The accord also unlocks plans for a bilateral summit next month. Pending regulatory review, the structure balances national security with commercial continuity.

INDICES PERFORMANCE

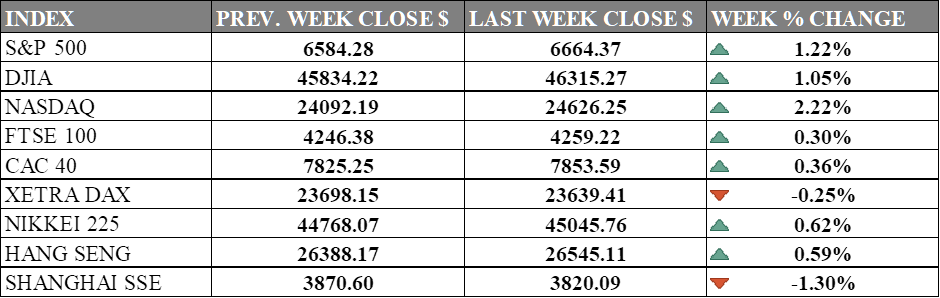

Wall Street’s major indices noted another record highs this week due to the Federal Reserve’s first interest rate cut in nine months and renewed optimism over U.S.-China trade relations. The S&P 500 climbed 1.22% to 6,664.37 as investors welcomed the Fed’s 25-basis-point cut, widely seen as a “risk management” move as labour market downturn risk increase. The Dow Jones Industrial Average rose 1.05% to 46,315.27, supported by broad-based gains and easing recession fears. The Nasdaq led with a 2.22% jump to 24,626.25, driven by strong performance in technology services and consumer durables as lower rates boosted appetite for growth stocks.

European markets posted modest gains, reflecting global risk-on sentiment after the Fed’s dovish shift. The UK’s FTSE 100 edged up 0.30% to 4,259.22, while France’s CAC 40 gained 0.36% to 7,853.59. Germany’s XETRA DAX slipped 0.25% to 23,639.41, weighed down by manufacturing weakness and soft housing data, though global momentum helped contain losses.

Asian markets were mixed. Japan’s Nikkei 225 rose 0.62% to 45,045.76 on export optimism and global monetary easing. Hong Kong’s Hang Seng Index advanced 0.59% to 26,545.11 as trade progress between the U.S. and China, including a breakthrough on TikTok, lifted sentiment. In contrast, China’s Shanghai Composite fell 1.30% to 3,820.09 as domestic selling and uneven economic recovery overshadowed global tailwinds.

CRUDE OIL PERFORMANCE

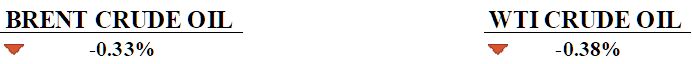

Oil tumbled a third of a percent this week as swelling supply due to OPEC+ easing cuts, resilient Russian exports, and rising Iraqi flows collided with weaker demand, dashing hopes the Fed’s modest rate cut would revive consumption. Analysts dismissed the 25-basis-point move as insufficient, noting a weaker dollar and seasonal refinery outages further dampened appetite, calling instead for bolder monetary action to reflate demand. Geopolitical tremors briefly reversed the slide: Russian incursions near NATO airspace and Ukrainian strikes on refineries reignited energy security fears, nudging prices higher over the weekend. Middle East tensions flared with Western recognition of Palestine, but crude flows remain untouched for now. China’s strategic stockpiling offers a lone buffer against the glut. Until fundamentals rebalance or supply tightens meaningfully, oil remains hostage to fleeting risk premiums and stubborn oversupply.

OTHER IMPORTANT MACRO DATA AND EVENTS

Japan’s August CPI eased to 2.7% from 3.1%, with core inflation also moderating but still above the BOJ’s 2% target, reinforcing expectations the central bank will hold rates steady at 0.5% while leaving the door open to future hikes.

U.S. jobless claims eased to 231,000 last week from a revised 264,000, but remained near the highest level since 2021, reinforcing sentiment of a weakened labour market that influenced the Fed’s recent rate cut.

What Can We Expect from The Market This Week

SNB Interest Rate Decision: The Swiss National Bank is scheduled to announce its monetary policy decision, with markets expecting rates to remain unchanged at 0% after the SNB cut rates to zero in June 2025. The consensus among economists suggests no change is likely, as inflation has remained within the SNB's target range and the central bank has indicated a high bar for returning to negative rates.

US Durable Goods Order: US durable goods orders fell 2.8% to $302.8 billion in July, extending the revised 9.3% decline from June but performing better than expectations. The decline was driven primarily by transportation equipment, while excluding transportation, new orders actually increased 1.1%, suggesting underlying manufacturing demand remains relatively stable, prompting forecasters to maintain a higher figure for August.

US PCE Price Index: The Personal Consumption Expenditures (PCE) price index showed core inflation rising to 2.9% year-over-year in July, the highest since February and above the Federal Reserve's 2% target. Headline PCE inflation remained at 2.6%, consistent with expectations, indicating persistent inflationary pressures that perplex the Fed as the market demand a risky cut.

US GDP Q2: Second preliminary data shows the US economy growing at an annualised rate of 3.3% in the second quarter of 2025, stronger than the initial 3.0% reading. This growth followed a 0.5% contraction in Q1 2025, going against headwinds from tariffs and higher interest rates.

US Existing Home Sales: Existing home sales increased by 2.0% to a seasonally adjusted annualised rate of 4.01 million units in July, the sharpest increase since February. The rise was noted alongside an increase in the median home price to $422,400, suggesting some stabilisation in the housing market, though affordability issues remain.