Investors are somewhat optimistic ahead of the Federal Reserve’s December 9-10 meeting, with markets pricing in an 87% to 89% chance of a 25 basis point rate cut, according to CME FedWatch data. Wall Street slipped on Monday as traders awaited signals from what many describe as the Fed’s most internally divided committee in years, with some officials still worried about inflation regardless of slower consumer spending. Treasury yields somehow moved higher, weighing on equities, though lower rate expectations improved its appeal. The outcome of the meeting will determine whether stocks can extend early December gains into a famous Santa Claus rally or receive coal if the Fed’s message diverges from mainstream mind. Strategists advise that until the decision and guidance arrive, markets will likely remain directionless, caught between hope for continued easing and risk over the Fed’s stance on inflation.

The Federal Reserve recently cut interest rates by 25 basis points in a divided 9-3 vote, a notable shift in priorities. This decision lowered the federal funds rate to a range of 3.50%-3.75%, continuing the easing cycle that began earlier in the year. According to the December dot plot projections, officials anticipate further reductions with the rate potentially reaching the low-3% range by the end of 2027. The Fed's rhetoric has also shifted from its previous hawkish stance to acknowledging fading inflation pressures without significant economic deterioration. Investors are responding by positioning portfolios for continued economic growth, favouring rate-sensitive sectors like real estate and technology while maintaining cautious exposure to longer-duration assets. Market participants are closely monitoring the Fed's updated economic projections released to adjust their investment strategies accordingly for the coming year.

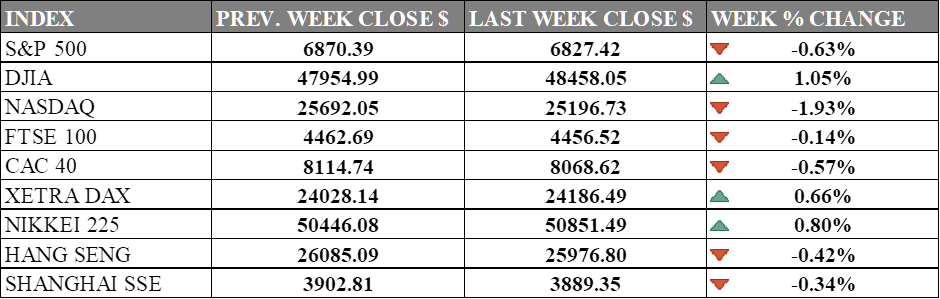

INDICES PERFORMANCE

Wall Street's major indices posted mixed results this week. The Dow Jones Industrial Average rose 1.05% to 48,458.05, while the S&P 500 declined 0.63% to 6,827.42. The Nasdaq underperformed, falling 1.93% to 25,196.73, as technology stocks faced profit-taking and valuation concerns since fed rate cut is likely to dry up going ahead. Market sentiment remained cautious amid ongoing assessments of corporate earnings, evolving expectations for Federal Reserve policy, and macroeconomic data releases.

European markets showed a mixed picture. Germany's XETRA DAX gained 0.66% to 24,186.49, continuing its upward trend. However, the UK's FTSE 100 edged lower by 0.14% to 4,456.52, and France's CAC 40 declined 0.57% to 8,068.62. Investor sentiment in the region reflected a balance between resilient corporate performance and lingering concerns about economic growth and monetary policy adjustments this week.

Asian markets were mostly lower this week. Japan's Nikkei 225 advanced 0.80% to 50,851.49, bucking the regional trend in line with its currency devaluation ahead of its central bank decision. In contrast, Hong Kong's Hang Seng Index slipped 0.42% to 25,976.80, and China's Shanghai Composite declined 0.34% to 3,889.35. Despite some positive signals from policy discussions in China, investor caution persisted due to global macroeconomic uncertainties and sector-specific headwinds.

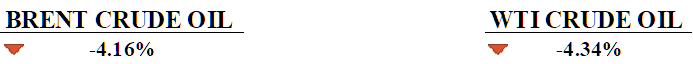

CRUDE OIL PERFORMANCE

Crude oil benchmarks continued their decline with WTI settling around $57.52 per barrel, down 4.34% on the final trading day. Brent crude similarly declined to $61.21 per barrel, marking a smaller 4.16% weekly drop. The ongoing price weakness mainly stems from continued concerns about global oversupply and weakening demand prospects in key markets. Market participants remain cautious as crude oil prices trade at multi-year lows, with Brent down approximately 17.74% year-to-date. Technical indicators suggest further downside pressure may persist in the near term as prices struggle to find meaningful support levels.

OTHER IMPORTANT MACRO DATA AND EVENTS

The EU agreement to indefinitely freeze of Russian assets enables a landmark loan to Ukraine that essentially advances future Russian war reparations.

The UK economy shrank again in October as budget uncertainty slows growth, even with a rebound in manufacturing and forecast upgrade.

What Can We Expect from The Market This Week

BoE Interest Rate Decision: The Bank of England is widely expected to cut interest rates by 25 basis points to 3.75%, the lowest level in nearly three years, given a weakening UK economy that fell by 0.1% in October. This would be the latest in a series of rate cuts aimed at supporting growth while inflation remains elevated at 3.6%, clear signs of stagflation.

ECB Interest Rate Decision: The European Central Bank to hold rate at 2.15% for a fourth consecutive meeting, with economists forecasting rates will remain at this level through the end of 2026. After eight consecutive rate cuts from June 2024 to June 2025, the ECB is pausing as inflation remains close to the 2% target.

BoJ Interest Rate Decision: The Bank of Japan is highly likely to raise interest rates by 25 basis points to 0.75%, with markets pricing in a 92-98% probability of a hike. This would mark the highest rate in 30 years as the BoJ responds to a weak yen and better wage growth, continuing its gradual normalisation away from ultra-loose monetary policy.

US CPI November: The November headline inflation report is forecasted to rise 0.2% month-over-month and 3.0% annually. The report's release was delayed due to a government shutdown and notably will not include 1-month percent changes due to missing October data, making the reading more challenging to interpret.

US Nonfarm Payroll: The November nonfarm payrolls, delayed from the typical first Friday due to a government shutdown, have now become the main focus, with economists expecting moderate job growth after September's 119,000 additions. The private ADP report showed private payrolls fell by 32,000 in November, setting a grim precedent.