The U.S. presidential election is a month away, and as the campaigns ramp up, so too will political uncertainties, accompanied by polarizing rhetoric and headlines. This term election will weigh the pros and cons of a Trump versus Biden on key policy elements such as taxes, regulation, and the government’s role in the economic growth. U.S. presidential elections can be tough on the nerves, and 2020 promises to be no different, except this year we get some added spices to it, coming the pandemic, racial tension, and heightened international conflicts and disputes.

As politics bring out emotions and bias, the question is, do presidential elections influence the stock market?

Presidential Election Cycle Theory

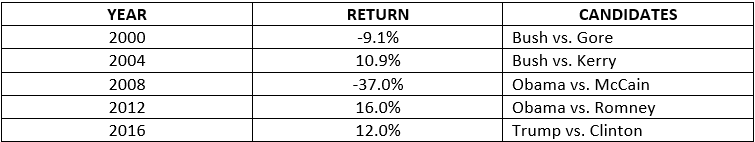

According to the Presidential Election Cycle Theory, developed by Yale Hirsch in 1967, U.S. stock markets are weakest in the year following the election of a new president. In the last five election, the first election year of market results for the S&P 500 showing as follow:

Meanwhile the market results for the S&P 500 for every election year since 1928, only four out 23 first presidential election years noting negative result, which were the years 1932, 1940, 2000, and 2008. Understandably, out of the four, most had evident justifications backing. The year 1932 was around the Great Depression, 1940 was on the brink of World War II, 2000 was the tech bubble bust, and 2008 was the financial mortgage crisis. So, will 2020 follow suit with the COVID-19 pandemic?

However, the Presidential Election Cycle Theory also suggesting that markets improve and perform best in the second half of a presidential term, as the sitting president tries to boost the economy to get re-elected.

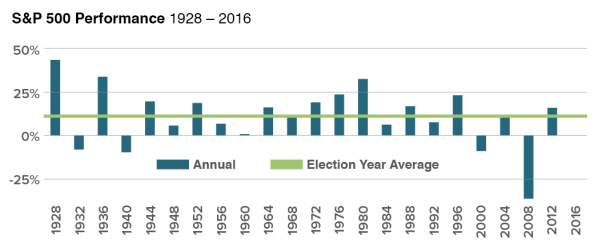

Meanwhile, in the post-election years, history does reveal some more interesting trends. In a broad sense, the election does not really matter anymore. Looking at the chart above, the stock market has fluctuated under all presidents. But over time, the trajectory has been positive. Getting too hung up on what-ifs over the next four years means losing sight of the big picture.

Past Results Don't Guarantee Future Performance

However, against the theory, recent history has particularly challenged these patterns. During the presidencies of Barack Obama and Donald Trump, these stock market theories did not hold up. In each of Obama's terms, the first two years were more profitable than the third, and for Trump, the first year was more profitable than the second, before a major surge in his third year, followed by the fluctuating, coronavirus-plagued markets of 2020. For investors trying to time the markets during these presidential terms, know that performance did not match past market data. If you were to follow the theory that the fourth year of a term sees better returns than the first term, the market in 2008 should have delivered better returns than it did in 2005, when George W. Bush started his second term as president and the S&P 500 Index gained 4.91%. But 2008, an election year, saw returns drop by 37.00%.

While the outcome is uncertain, on one hand, it is true that the stock market is cyclical, which makes it possible for investors to look to history to observe trends and make predictions. One cannot always count on future returns to match past ones. Despite some consistent patterns, election years are no exception to this rule. History shows that U.S. election results have very little impact on long-term returns. Volatility is to be expected, especially during U.S. election primary season.

PREDICTION - IF DONALD TRUMP WIN

In the 2016 election, market initially jumped, as he committed in pushing corporate tax cuts and relaxed business regulation. While investors expect a pro-business environment under Trump’s second term, mustn’t be forgotten the COVID-19 pandemic, economic recovery (after plunging into recession in February 2020) and U.S.-Sino tensions, could weigh on investor sentiment.

Wall Street analysts largely agree that if Trump wins re-election, sectors like defence, financials, and tech all stand to benefit while retail will take a hit. Also worth noting, the market actually performed better during a year when an incumbent president is elected compared to a new administration. This happened as the markets hate uncertainty. A new president can create more unknowns: the potential for increased regulations, higher taxes, and other shifts the market perceives as anti-business can all influence sentiment.

PREDICTION - IF JOE BIDEN WIN

In the past, a Democratic president supported by a Democratic majority in both houses of Congress usually resulted in an initial market sell-off, though recovered later. In his campaign, Joe Biden advocating some radical policy changes, including an overhaul to the health care system, breaking up big banks and tech firms, banning fracking, and imposing wealth taxes and higher corporate taxes to 28%. The Trump tax cuts had shrunk corporate taxes to 21% from 35%. In the matter of tension with China, rather than confronting head-on, Biden wants a coalition with international allies to pressure China on intellectual property and technology transfers.

If there is a Democratic win, sectors like renewable energy, utilities and infrastructure could benefit, while big tech and pharmaceutical companies would likely take a hit from increased government regulation.

All in all, the person elected president of the United States in November 2020 will have a unique and challenging task - managing the nation's economic recovery back on track after a global pandemic. Over the next two years, Fed has announced that monetary policy will remain loose no matter who wins, as will continued monetization of the public debt and strains in U.S.-Chinese relations. Both presidencies will be focused on getting the economy back on track after COVID-19.

So, what can we learn from all this? While some clear patterns between market performance and presidential elections have emerged, past performance is no guarantee of future results. Be as it may, the stocks measure didn’t only depend on these results, rather on several other multiple factors, many of which are outside the control of government. Natural disasters, terrorism, political scandal or turmoil, geopolitical tensions, trade policy, international relations, and the relative strength of the dollar are just a few factors. We think the combination of a sustained but gradual economic expansion, an extension of monetary-policy stimulus and a rebound in corporate profits will set the broader course for the markets.

Thus, the best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals—regardless of who prevails in November. It might be better to invest in a less exciting but safer way, which involves understanding risk and return, diversifying, and buying funds to own for the long term, no matter who wins the election.