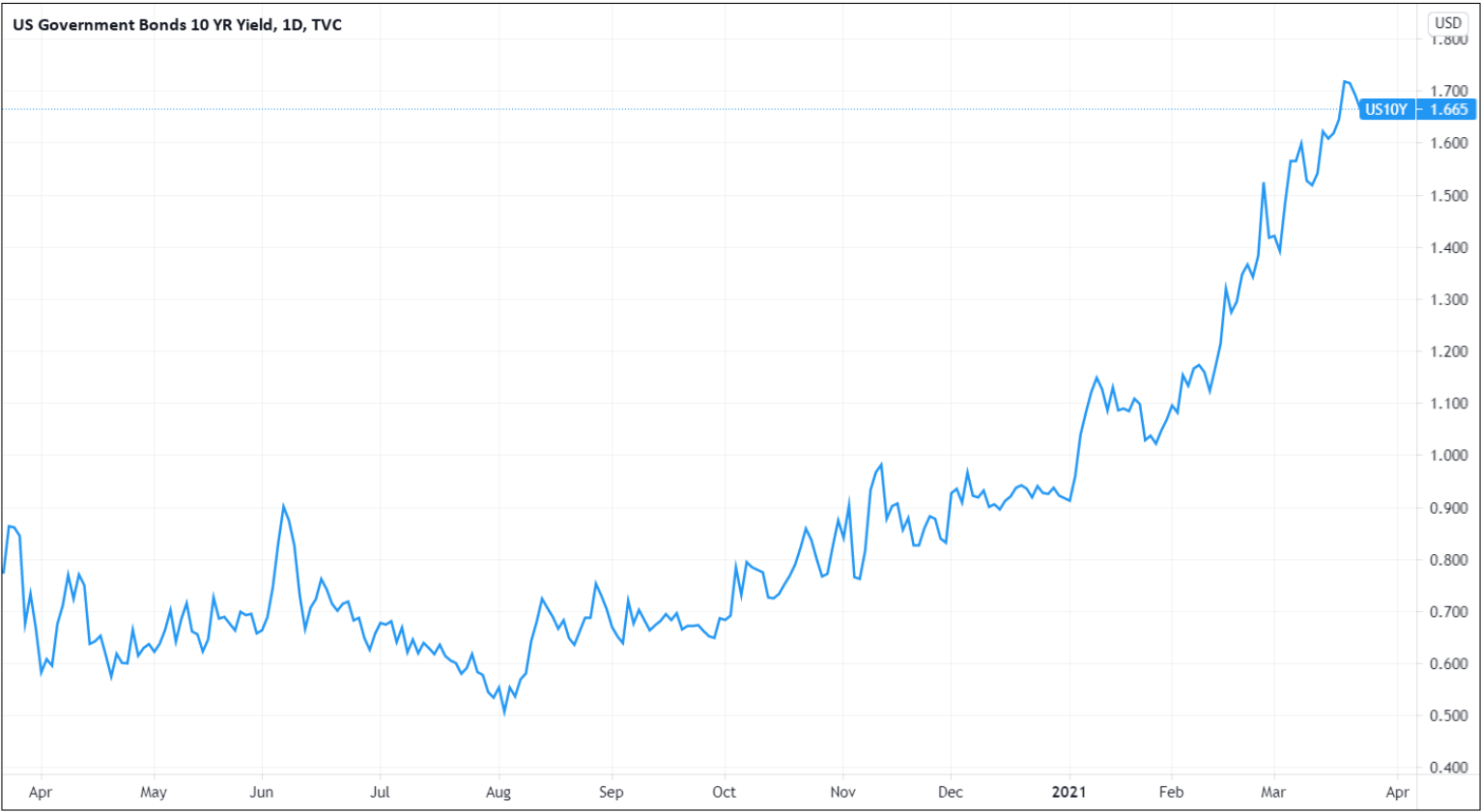

A surge in bond yields, fears about rising inflation and a jump-forward in interest rate expectations has been on top of investor’s mind following these recent days events. The 10-year Treasury yield broke above 1.75% on March 18, marking its highest level since January 2020, when it topped out at 1.762%, while at the end of last year, the yield was just 0.92%. This is also the first time the 30-year has traded above 2.5% since August 2019.

Bond yields play a significant role in determining the direction of a currency. The difference between one countries bond yield and another countries bond yield, known as an interest rate differential, is more influential on the direction of a currency than the actual bond yield.

Firstly, what is bond yield and currency pairs?

Bond Yields

A sovereign bond yield is the interest rate where a government can borrow capital. Bonds are interest rate sensitive securities in which the public can lend to sovereign governments, municipalities, or corporations. Short-term interest rates are generally driven by central bank policies, while bond yields fluctuate more with market sentiment. Bond prices and bond yields are inversely correlated. When bond prices rise, bond yields fall and vice-versa.

Government bonds tend to have lower yields when compared to other investment assets like stocks due to their perceived safety. This is because coupon payments on government bond instruments are virtually guaranteed, so they are considered to be very safe investments.

Currency Pairs

The basic security that is traded within the foreign exchange market is called currency pairs. A currency pair is the relative rate between one countries currency and another countries currency. For example, when the exchange rate for the currency pair EUR/USD is 1.19, an investor can purchase 1 Euro for $1.19. When an investor trades a currency pair, they are simultaneously purchasing one currency and selling another currency.

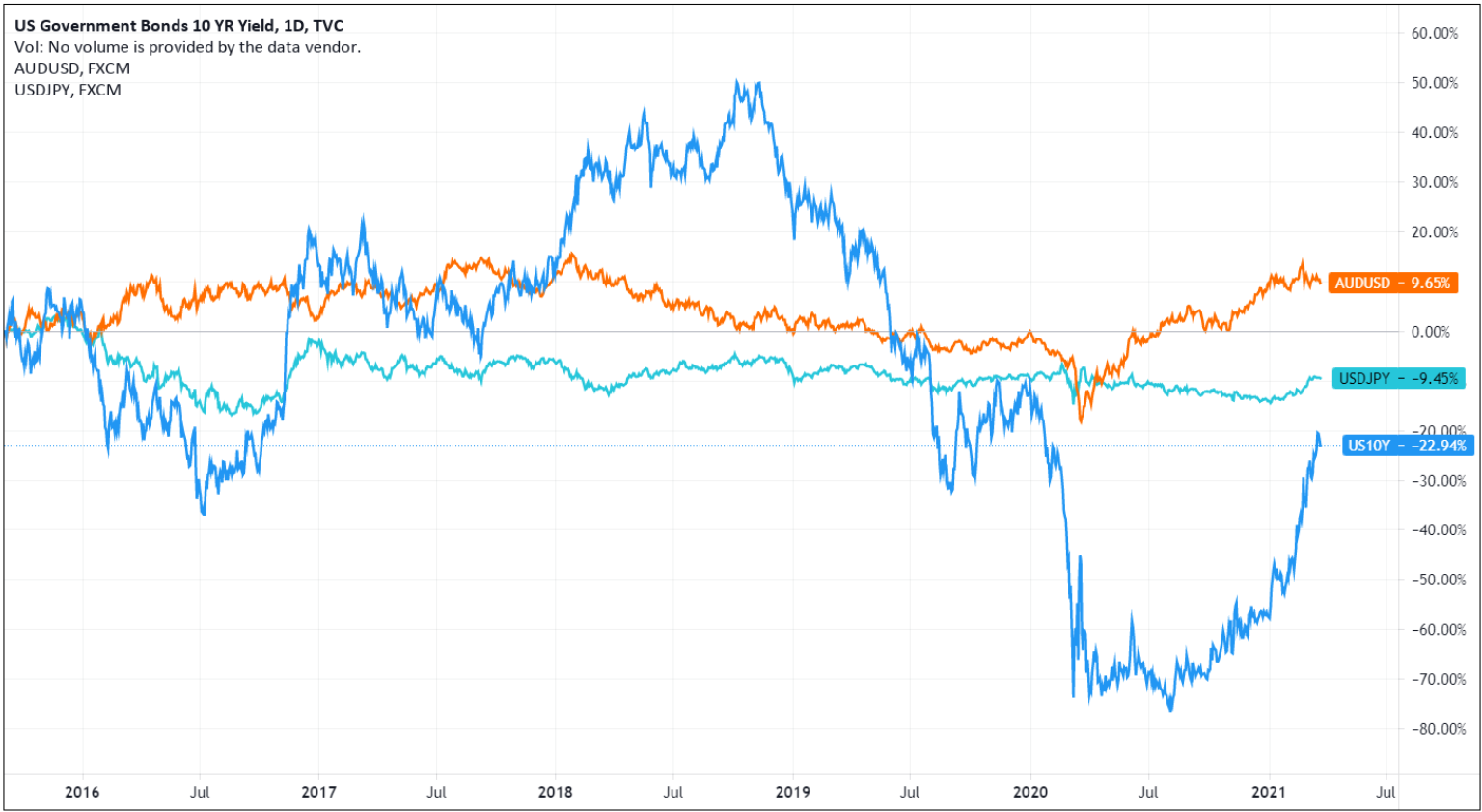

Bond yields differentials usually move in tandem with currency pairs. This phenomenon occurs because capital flows are attracted to higher yielding currencies. When people are willing to take risks, the rate of one currency increases relative to another, as investors are attracted to the higher yielding currency. Additionally, the cost of owning the lower yielding currency increase as the bond yield differential moves in favour of the currency that is sold. For example, the cost to owning the yen and selling the dollar will increase as U.S. bond yields increase relative to Japanese bond yields.

As a rule of thumb, short-term, when a central bank raises rates (yields rise, bond prices fall), the currency appreciates as it becomes more attractive to hold.

See the move of the Australian dollar (high yielding), and the Japanese yen (low yields) as an illustration. Notice how the blips on the charts are near-perfect mirror images, whereby AUD moves in tandem with the yield, and vice versa for JPY.

The relationship also used in monetary policies. to A stronger currency helps to hold down inflation while a weaker currency will boost inflation. Central banks usually take advantage of this relationship as an indirect means to effectively manage their respective countries' monetary policies. By understanding and observing these relationships and their patterns, investors have a window into the currency market, and thereby a means to predict and capitalize on the movements of currencies.

The higher bond yields indicate a risk of higher U.S. interest rates. Also, the high yield bonds will attract foreign investors. As people start selling its currency, the exchange rate falls. This will raise inflationary pressures, as prices of imported goods increase immediately, and prices of exported goods rise afterwards. The central bank will then raise interest rates, to fight inflation and protect its currency. When yields rise, prices of bonds fall, and there you have it: the currency and bonds fall at the same time.

Later today, the Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen are expected to make their first joint appearance before the U.S. House Financial Services committee to testify on Fed and Treasury pandemic policies.

In last week FOMC meeting, Fed Chair Jerome Powell and his colleagues remained dovish in the interest rates decision. The U.S. Federal Reserve’s policymaking committee voted to keep short-term borrowing rates near zero in a widely expected move. The Fed also ramped up its expectations for economic growth by 6.5% this year but indicated that there are likely to be no interest rate hikes through 2023.

Investors will be looking for signs of whether the U.S. central bank’s outlook for the economy has changed due to the ongoing COVID-19 vaccination program and other developments.